- D2C Caffeine

- Posts

- “Customer Listening” — Why (most 🤷♀️) Indian brands suck at it.

“Customer Listening” — Why (most 🤷♀️) Indian brands suck at it.

Indian D2C customers are not subtle - especially during Holidays!

A regular dose of D2C-centric resources & tools for Growing Brands, Startups & Entrepreneurs.

“Customer Listening” — Why (most 🤷♀️) Indian brands suck at it.

“Your Customer Wanted to Tell You Something…”

(Spoiler: They Did — You Just Weren’t Listening)

Indian D2C customers are not subtle.

They abandon carts.

They refuse COD orders.

They don’t answer delivery calls.

They raise return requests at 11:47 pm.

They vanish during NDRs.

And then… brands say:

They’re not.

They’re extremely consistent — if you know where to listen.

The real issue in Indian eCommerce is not lack of feedback.

It’s selective deafness.

Most brands listen only at the end:

Support tickets

Reviews

NPS surveys

By then, the revenue damage is already done.

High-performing Indian D2C brands do something very different.

They practise Customer Listening as an operational discipline, not a CX ritual.

You’re just listening at the wrong places — or worse, on the wrong dashboards.

Let’s fix that…

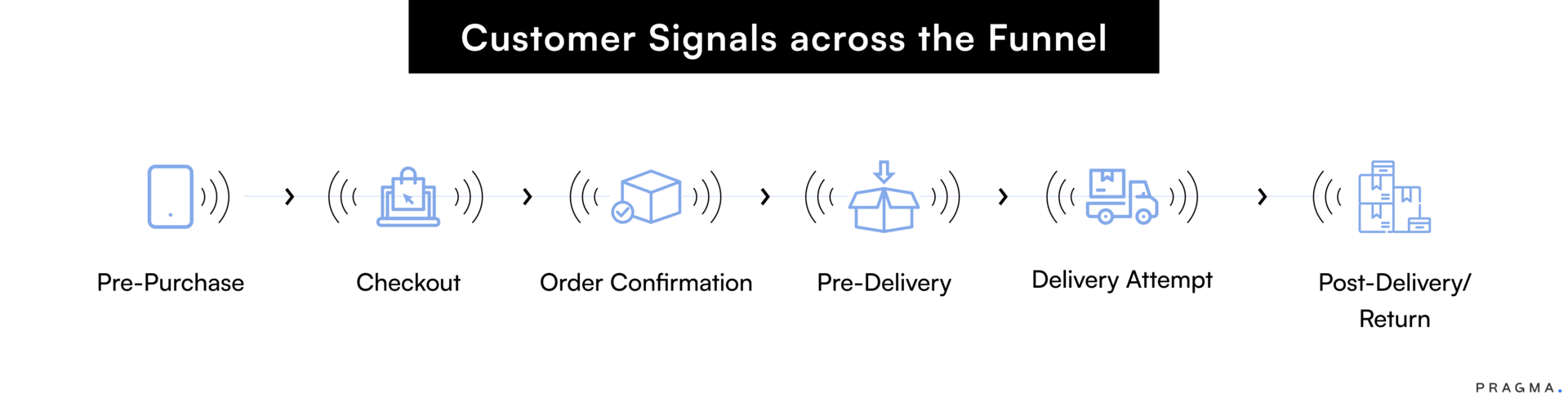

Listening Stage 1: Pre-Purchase

Listening Before the Wallet Opens

Before a customer clicks Buy Now, they’re already telling you things:

They’re switching between UPI and COD

They’re hesitating on address fields

They’re dropping off at payment

They’re bouncing on delivery promises

This isn’t “behavioural psychology”.

This is checkout telemetry.

What customers are actually saying:

“Your checkout is too slow.”

“I don’t trust this delivery promise.”

“Why is COD suddenly disabled?”

“Why am I entering my address like it’s 2012?”

What Pragma listens to here:

Checkout drop-offs by payment mode

COD enablement logic by pincode

Address validation failures

ROAS leakage due to checkout friction

With 1Checkout, this is where:

Payment intent failures are visible in real time

Pincode-level COD logic adapts dynamically

Address intelligence reduces fake/failed deliveries

Media spend doesn’t die at the final step

Most brands wait until the order fails.

Smart brands prevent the failure from existing.

Listening Stage 2: Post-Order, Pre-Delivery

Where Customers Start Losing Patience

This is the most ignored listening layer in Indian D2C.

Once the order is placed, brands relax.

Customers don’t.

This is where:

Delivery timelines slip

NDRs start piling up

Couriers go silent

Support tickets explode

What customers are actually saying:

“Why hasn’t my order moved?”

“Why did the courier not call?”

“Why is delivery failing without reason?”

“Why am I finding this out on WhatsApp, not from you?”

This isn’t a CX problem.

It’s an NDR + SLA visibility problem.

Pincode | Courier A NDR % | Courier B NDR % | Insight |

560001 | 12% | 4% | Possible doorstep issues |

110001 | 9% | 15% | Courier B performance drift |

400001 | 6% | 6% | Normal variance |

What Pragma listens to here:

NDR monitoring across couriers

SLA breaches by lane, partner, warehouse

False delivery attempts

Delayed first-mile handovers

With ShipAxis + JMS (Journey Management System) + Omnichannel CRM, brands get:

A single dashboard for shipment health

Real-time alerts for stuck or risky orders

Proactive customer communication (before anger sets in)

Courier accountability backed by data, not arguments

Customers don’t want apologies.

They want predictability.

Listening here prevents:

RTOs

Support overload

Social media meltdowns

“Never ordering again” moments

Listening Stage 3: Delivery & NDR Moments

The Most Honest Customer Feedback You’ll Ever Get

If a customer refuses delivery, they’ve given you feedback.

If an NDR reason repeats across pincodes, that’s feedback too.

If COD orders fail disproportionately in certain zones — congratulations, that’s a focus group you didn’t pay for.

What customers are actually saying:

“I wasn’t available because delivery timing was random.”

“The courier didn’t call.”

“I lost trust midway.”

“I changed my mind because delivery felt uncertain.”

What Pragma listens to here:

RTO patterns by SKU, pincode, courier

Repeat NDR reasons

COD risk signals

Agent-level performance issues

The Pragma RTO Suite turns this noise into:

Actionable suppression logic

Pincode-level COD intelligence

Courier re-routing

Revenue loss prevention

This is not post-mortem analysis.

This is live damage control.

Example:

One of our D2C fashion brands observed:

Saturday peak orders

40% RTO spike on COD

Most “Reason Given” — “Not at home”

Upon digging:

Delivery windows weren’t communicated

Courier didn’t call beforehand

Solution?

WhatsApp delivery alerts

NDR-triggered follow-ups

Learning:

Listening means correlating:

👉 Omnichannel CRM + WhatsApp Business Suite = automated delivery notifications + pre-arrival calls.

Listening Stage 4: Post-Delivery

Where Brands Usually Stop Listening (Big Mistake)

Most brands think the journey ends at “Delivered”.

Customers disagree.

Post-delivery is where:

Returns happen

Refund anxiety begins

Trust is either cemented or destroyed

What customers are actually saying:

“Why is return pickup delayed?”

“Why is my refund stuck?”

“Why am I repeating my issue to three teams?”

“Why does no one know the status?”

This is where bad systems quietly burn brand equity.

Signal | What It Indicates/Means |

Delayed Return Pickup | Process friction |

Refund Pending > 72 hrs | Trust erosion |

Repeat complaints for same SKU | Product quality alert |

Return initiation reason | Product or expectation gap |

SLA breach | Trust erosion |

What Pragma listens to here:

Return initiation reasons

Pickup SLA breaches

QC delays at warehouse

Refund cycle time leakage

With Pragma RMS, brands get:

Rule-based return approvals

Automated QC workflows

Warehouse-level monitoring

Finance-ready audit trails

Refund visibility without manual chasing

Returns are not a cost centre.

Unmanaged returns are.

Listening Stage 5: Continuous Listening (The Part Humans Can’t Do Alone)

At scale, no ops team can manually connect all these dots.

People Can’t Do This Alone

Once you cross scale:

Multiple warehouses

Multiple couriers

Thousands of daily orders

Manual analysis collapses.

This is where Pragma Genie (AI Copilot) comes in.

Not to write poetry.

To answer questions like:

“Why did ROAS drop despite stable traffic?”

“Which courier is silently increasing RTO this week?”

“Which SKU is causing disproportionate returns?”

“Which warehouse is breaching SLAs today?”

What Genie (AI Copilot) lets you access

Checkout behaviour

Shipment health

NDR trends

Returns & refunds

SLA breaches

ROAS fluctuations

…and translates noise into decisions.

Pragma’s Customer Listening Stack (End-to-End)

Journey Stage | |

Pre-purchase | 1Checkout + Omnichannel CRM + JMS (Journey Management System) |

Order monitoring | ShipAxis + RTO Suite |

Customer comms | Omnichannel CRM + WhatsApp Business Suite + JMS |

Returns & refunds | RMS (Return Management System) + RTO Suite |

Intelligence layer | RTO Suite + Pragma Genie (AI Copilot) |

SLA & warehouse | ShipAxis + Real-time Dashboard |

One journey.

One listening system.

One D2C Operating System - Pragma.

The Real Problem Isn’t Customer Silence

It’s Brand’s (selective) Deafness.

Indian D2C customers are loud.

They complain.

They abandon.

They refuse.

They return.

They ghost.

They’re not subtle.

If your brand still feels “surprised” by RTOs, refunds, or churn — you’re not lacking customers.

You’re lacking listening infrastructure.

TL;DR

Customers speak through behaviour, not surveys.

Listen before checkout fails (payment switches, COD drops, address friction).

Listen before delivery fails (NDRs, courier SLAs, shipment delays).

Listen after delivery (returns, refund speed, repeat issues).

Connect all signals in one system — or revenue keeps leaking quietly.

That’s the end of our talk on “Customer Listening — Why (most 🤷♀️) Indian brands suck at it.”...

☕ See you on the next coffee date!

How did you like our Newsletter? What topic would you like us to cover next?

Reply and let us know! 😊